Lithium Ion Battery- Value Chain Challenges

Lithium Ion battery was first commercialised in 1991, leading the battery market from various portable devices to mobiles and laptops due to its high energy density, efficiency and better cycle life. The recent climate change initiative has set a high dominance on batteries due to their increased adoption in Energy storage and Electric vehicles. As per the India Energy Storage Alliance (IESA) report, the Indian electric vehicle market is expected to expand at an annual growth rate of 49% during 2021-2030, eventually increasing the battery market to $7 billion in India alone. Similarly, it is estimated that 387GW/1,143GWh of new battery energy storage to be added globally from 2022 to 2030.

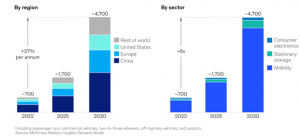

As a result, the global lithium-ion battery market is expected to grow annually by 27% to reach the global target of 4700 GWh by 2030. Batteries for mobility take a more significant share in this which the following three considerable drivers drive:

- A global shift towards energy transition and sustainability, which includes net zero targets by international countries, Europe’s “Fit for 55” program, the 2035 ban on internal combustion engine (ICE) vehicles through the US Inflation Reduction Act and India’s FAME (Faster Adoption and Manufacture of Hybrid and Electric Vehicles) scheme

- Increased trend in the consumer demand for greener technologies

- Decision taken by 13 top OEMs to ban ICE vehicles to achieve new emission-reduction targets.

Though battery growth will result in multiple environmental and social benefits, the battery value chain faces significant ecological, economic, governance, Implementation and Industrialisation challenges and risks.

- Environmental: Raw material extraction and cell manufacturing processes impact the environment through land degradation, hazardous waste, and air/soil/water contamination. Also, battery disposal is another threat that may cause severe pollution.

- Economic: Though lithium-ion declined by 90%, 2022 witnessed a steep increase in the price, hitting an all-time high of $70,000 per tonne, a 13-fold increase in 2 years. The boom in price is mainly due to a severe shortage in lithium as the supply chain is dependent on Chinese manufacturers, who control 70%-80% of the supply chain. Thus, the higher price and volatility may drastically affect the economic viability of projects.

- Governance: This includes regulatory harmonisation and standardisation, proper planning on incentives, subsidies and taxes

- Implementation and Industrialisation: While economic and other challenges are apparent, implementation and industrialisation become the real threat. This include

- Disruptive supply chain

- Raw material shortage

- Technology disruption

- Scarcity of talent and skilled labour

- Social acceptance

Lithium reserves are mainly distributed across Argentina, Australia, Chile, and China, Australia being the top producer with around 50,000 MT of production in 2021. Chile stands second with about 26000 MT of production, and China stands third with 14,000 metric tons. These three countries contribute to almost 90% of the world’s output. 5.9 million tonnes of lithium have been found in Jammu & Kashmir recently. China is the largest consumer of lithium due to its massive electronics and electric vehicle (EV) industries. China controls most of the world’s lithium-ion manufacturing and processing facilities by catering to almost three-quarters of the worldwide requirement. Further, the encouragement the Chinese government provides through subsidies is expected to increase the sales of lithium-ion batteries in the region.

Cobalt is the next critical element of the battery, mainly as a by-product of copper and nickel production. 75% of its share is concentrated in the Democratic Republic of Congo (DRC). While cobalt deficiency may be unlikely, volatility in supply and price may continue as it is generally obtained as a by-product.

Nickle, the other major component in NMC (Lithium Nickle manganese cobalt oxide) type battery, its reserves are spread across various countries, including Australia, Canada, Indonesia and Russia. It is estimated that the shortage of Nickle will be negligible in 2030 due to the recent transition to LFP (lithium iron phosphate) chemistries. Manganese is expected to experience a slight supply shortage through 2030 as LMFP (lithium manganese iron phosphate) chemistry may gain a higher market share.

Thus, the supply chain challenges, including the shortage of lithium, may impact the EV and battery energy storage goals. To mitigate and overcome the challenges, manufacturers and industries may explore and adopt new sustainable business models

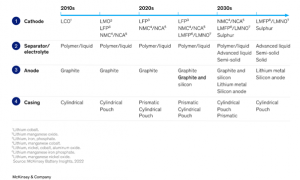

- Innovations in battery technology to adopt new and sustainable materials. Some recent advancements include new chemistries such as solid-state batteries, sodium ions and changes in cathode and anode materials. Apart from cell chemistries, improvements in cell and packaging production technologies are also being explored, including dry electrode coating and cell-to-pack design. The innovation journey that happened in the last decade and is expected in years ahead is depicted below.

- Creation of a circular value chain: Producers and purchasers must shift from a linear value chain to a circular value chain wherein the materials will be reused and recycled. This transformation may create better market opportunities with high economic potential. It will also support mitigating the risks of battery-waste disposal. EU battery directive has set a recycling target of 80% by 2030, which would become the aspiration for all stakeholders.

- Minimising environmental impacts beyond climate: Apart from the well-known target of building low-carbon batteries, stakeholders should also ensure creating positive environmental impact through the value chain adhering to the Kunming-Montreal biodiversity agreement, i.e., a target to restore 30% of the degraded terrestrial area including inland water, coastal and marine ecosystems.

- Harmonising international standards and regulations: Diverging standards and local regulations pose a barrier to faster scale-ups and lead to increased costs. Harmonisation could assist in achieving global goals,

The Energy transition initiative and goals have increased global demand for batteries. To meet the battery demand in 2030, it is imperative to emphasise sustainable raw material & product technologies with a circular value chain, collaborative actions, harmonised processes and regulations, and greater data transparency.